UPSTAR Bank Loan: The guide to securing the best conditions

Loans can be a valuable tool to help achieve financial goals, whether it’s buying a house, paying off debts or even investing in a new venture. However, finding a loan with the best conditions is not always an easy task. That’s where Banco UPSTAR comes in, offering a reliable and affordable solution for those looking for loans in the United States.

Banco UPSTAR stands out in the loan market for its commitment to transparency, agility in the approval process and competitive rates. With a wide range of loan options, from personal loans to real estate financing, they meet the needs of different customer profiles. Always striving to excel in these small details for the best user experience.

In this guide, we’ll give you everything you need to know about the UPSTAR Bank Loan. From the application process to eligibility criteria and best practices for securing the best conditions, we’ll help you take the first steps towards a loan solution that meets your needs.

Why choose Banco UPSTAR for your Personal Loan?

With extensive experience in the financial market and a solid reputation, Banco UPSTAR offers a number of advantages to those seeking a quick and reliable solution to their credit needs.

One of the main reasons for choosing Banco UPSTAR is the ease and speed of the application process. When you take out a loan with Banco UPSTAR, you do not have to worry about red tape and long waiting times. The bank offers personalized service, where customers are assisted by highly trained professionals ready to help them at every step of the process.

In addition, Banco UPSTAR offers a wide variety of loan types to suit the different needs of the public. Whether it is a personal loan, a real estate loan, or an investment loan, Banco UPSTAR has the ideal solution for you. With competitive rates and flexible payment terms, this loan is the perfect choice for those seeking a secure and reliable financial solution.

Be sure to consider a Personal Loan with Banco UPSTAR. With its specialized service, variety of loan types, and agile process, Banco UPSTAR stands out as a reliable choice for those seeking credit on American soil. Don’t waste time and secure the financial solution you need now.

Step by step to apply for your loan at Banco UPSTAR

If you’re thinking of applying for a loan, UPSTAR Bank could be a great option for you. With a solid reputation and a wide range of financial services, UPSTAR offers an easy and affordable lending experience. Here is a step-by-step guide to help you apply for your loan at Banco UPSTAR.

Step 1: Do your research

Before applying for your loan, it’s important to understand the different types of loans available at UPSTAR Bank. They offer personal loans, vehicle loans and mortgage loans. Do some detailed research to determine which type of loan best suits your needs and financial conditions.

Step 2: Prepare your documentation

To apply for a loan at UPSTAR Bank, you will need to provide adequate documentation. This includes proof of identification, proof of income, credit history and information about any other existing debts. Make sure you have all the necessary documentation before you start the application process.

Step 3: Contact Banco UPSTAR

Once you have decided on the type of loan you want to apply for and have all the necessary documentation, contact Banco UPSTAR. They will have experienced professionals ready to help you through the whole process. They will guide you through filling in the application form, analyze your financial situation and determine if you are eligible for the loan.

By following this step-by-step process, you’ll be able to apply for your loan at Banco UPSTAR quickly and easily. Remember to carefully assess your financial conditions and needs before making any commitments. Banco UPSTAR is a reliable institution dedicated to helping its clients achieve their financial goals.

The unique advantages of the UPSTAR Bank Loan

Banco UPSTAR is a unique and advantageous option for those looking to obtain credit. With a variety of exclusive benefits, this type of loan stands out as a reliable and affordable option for those in need of extra cash.

One of the main advantages of Banco UPSTAR is the ease of access to credit. With a simplified and agile process, it is possible to apply for a loan and get an answer quickly and efficiently. In addition, Banco UPSTAR offers flexible payment terms, allowing customers to choose the best option to fit their budget.

Another great advantage of this exclusive loan is the competitive interest rate. With more attractive rates compared to other financial institutions, Banco UPSTAR offers an excellent opportunity for those looking for a cost-effective loan. This means that the customer will save money by opting for this type of credit.

So if you need a reliable, affordable loan with competitive rates, Banco UPSTAR is the right choice. Take advantage of the exclusive benefits offered by this renowned financial institution and get the credit you need simply and safely.

Personal loans with exclusive advantages…

UPSTAR: Best loan options – See how to get one!

Personal Loan Quick LoansWondering how to get a loan with a poor credit history? UPSTAR breaks that belief with its exclusive offers.

You will remain on the same site

How to get quick and easy approval with Banco UPSTAR

Nowadays, many people need loans to achieve their financial goals, whether it’s to pay off a debt, buy a new car or even invest in a business. However, the process of obtaining a loan can often be lengthy and complicated. That’s where UPSTAR Bank comes in, providing a quick and easy solution for those who need fast loan approval in the United States.

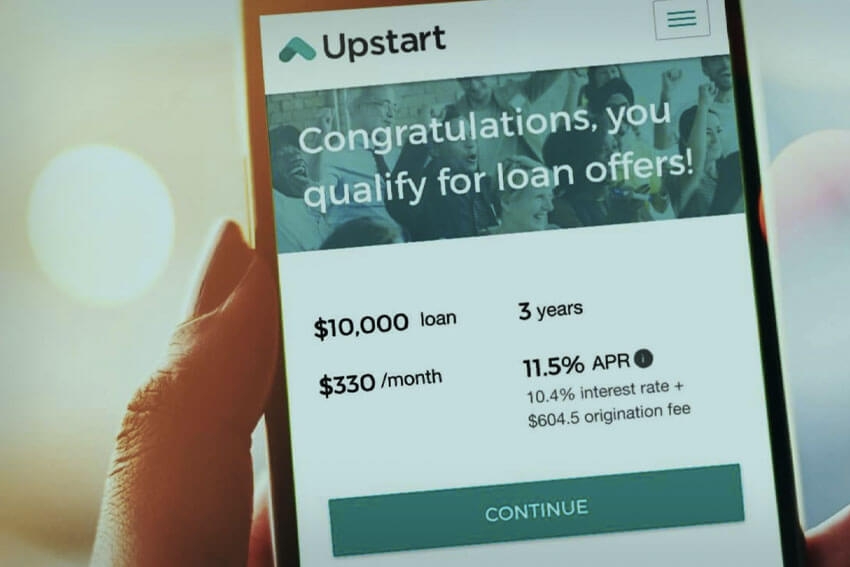

UPSTAR Bank is known for simplifying the loan granting process, offering its customers a superior experience. With an easy-to-use online platform, you can apply for and get approved for a loan from the comfort of your own home. The process is simple and straightforward, eliminating the need to fill out paperwork and visit bank branches.

The secret to UPSTAR Bank’s quick and easy approval process lies in its advanced technology. Through the use of sophisticated algorithms and data analysis, Banco UPSTAR is able to assess its clients’ credit profile quickly and accurately. This enables it to offer loan approvals in record time.

With its quick and easy approval process, you can get the loan you need to achieve your financial goals. Don’t waste any more time on unnecessary bureaucracy, apply for your loan with Banco UPSTAR and enjoy the speed and efficiency you deserve.